How Much Is E&o Insurance For Appraisers

Check_circle limits up to $1,000,000/$2,000,000. The cost of your policy depends on how much e&o/professional liability insurance coverage you buy.

Appraisers Eo Insurance - - Library Of The Us Courts Of Pages 1 - 3 - Flip Pdf Download Fliphtml5

Check_circle trainees needing higher limits are eligible to purchase their own policy.

How much is e&o insurance for appraisers. Coverage for residential, commercial & trainee appraisers; Policy limits determine how much e&o coverage costs. Where your clients are located;

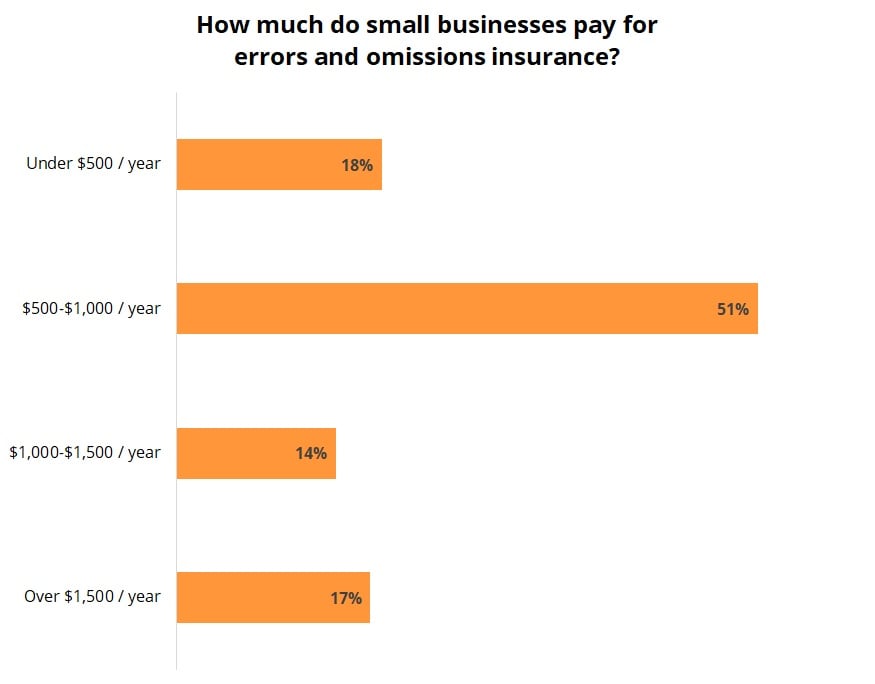

Real estate professionals, such as agents and appraisers, pay a median premium of $665 per year. Lia offers uncompromising quality with conservative pricing. Two years appraisal experience required.

Errors and omissions insurance for real estate appraisers, also known as appraiser e&o insurance, helps protect appraisers from costs related to professional liability claims. A missing contract clause or a failure to review a seller’s property disclosures could. $500k limits of liability and higher.

Tech e&o insurance costs vary from an average of roughly $730 per year to more than $1,400. The types of clients you work with; Insurance agents use pdf application.

It can cover the cost of lawsuits related to an appraiser's work performance and business decisions. Direct applicants get an instant quote. The average cost to defend a claim can run about $20,000 to $30,000, and that does not include any indemnity payment, which drives the cost even higher.

Appraisers can budget for their e&o premium, but not the sudden financial impact of an e&o claim without a solid insurance policy. Please note that many lenders/financial institutions have minimum limit requirements of $500,000/$1,000,000 for real estate professionals who do work for them. This coverage is designed to protect you if a customer ever claims that you made a professional mistake that caused financial hardship.

Free bodily injury/property damage coverage for the subject inspection Peace of mind, at your fingertips coverwallet utilizes state of the art technology to help small businesses understand and buy customized coverage, get significant savings and conveniently manage their insurance, in a matter of minutes, all through our online platform. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small real estate appraisal businesses ranges from $37 to $49 per.

Compare errors and omissions insurance quotes for your company. The median annual cost of e&o insurance is about $60 a month. E&o insurance will cover costs for legal defense and damages when claims are made against you up to the limits of your policy.

Protect your appraisal business and get a quote from the hartford today. Average costs for e&o coverage are usually $500 to $1,000 per employee, per year. How much does insurance appraiser insurance cost?

Everyone is human and prone to errors. Premiums starting at $501, including prior acts coverage with proof of continuous insurance; All great reasons to choose target professional programs for appraisers e &o insurance.

As an appraiser, it is wise to carry errors & omissions insurance in case you provide an incorrect valuation on a piece of real estate. The cost of appraiser insurance varies based on the risks that your business faces, such as: You must purchase e&o insurance prior to performing any professional service.

We have access to e&o programs that most insurance brokers don’t, to ensure you get the best protection at the best price. How much does notary e&o insurance cost? Appraisers and e&o insurance some states, including colorado, mandate that licensed real estate and commercial property appraisers obtain and maintain active errors and omissions policies.

We recommend the top 5 providers. Find out how much it costs, what it covers and more. Here are some examples of how a profession’s level of risk can impact the cost of e&o coverage:

Check_circle automatic $25,000 liability limit for trainees included*. Your payroll and the kinds of jobs your employees do; For example, let's say you perform an appraisal on a customer's household furnishings.

Real estate appraiser e&o insurance program highlights (specific coverage details vary by program, please ask your orep agent.) minimum premium: Coverage specifically for residential appraisers cres e&o has been created specifically for appraisers who specialize in residential properties. The number and types of vehicles you use at work;

It’s not a generic policy. $401, including prior acts coverage with proof of continuous insurance “a” rated carrier; Insurance appraisers professional liability coverage is also known as errors and omissions (e & o) insurance.

Appraisers e&o coverage is available with: Insurance does not provide coverage for events that took place prior to the inception date of the policy. Your e&o addresses your specific risks.

This is only an estimate. You can calculate insurance costs including errors and omissions (e&o) insurance cost by filling out our online application today. About us 229 seventh street | suite 303 | garden city, new york 11530 toll free:

Program features for real estate appraisers Appraiser e&o insurance covers you when you get sued. This policy is also called e&o or professional liability insurance.

So, if your business has 50 employees, you can estimate your errors and omissions premium to be between $25,000 and $50,000 per year. Check_circle $100,000 bodily injury/property damage included*. When we get quotes online from the best 4 insurance companies that we recommend below, notary e&o insurance costs are in the range of $30 to $104 a month.

Errors Omissions Eo Insurance In Port Jervis Tri-state Area Of Ny Pa And Nj - Johnson And Conroy Agency Inc

Eo Insurance - Insurance Insight And Advice From The Inside

Appraiser Eo Insurance Cost And Top 5 Providers - Bravopolicy

Top 6 Providers Of Real Estate Eo Insurance Costs - Bravopolicy

Real Estate Appraisers Eo Insurance

Appraisers Eo Insurance Appraisers Errors And Omissions Eo Insurance

Errors And Omissions Eo Insurance Cost Insureon

Get Affordabe Errors And Omissions Insurance- Eo Coverage

Errors Omissions Eo Insurance In Hammond And Crown Point Indiana - Rosenwinkel Insurance

What Is Eo Insurance Tail Coverage And How Does It Work In Real Estate Vaned

Appraiser Eo Insurance Cost And Top 5 Providers - Bravopolicy

How To Get Professional Liability Insurance Professionalscoverageca

Youve Worked Hard To Achieve Your Status - We Work Hard So You Can Keep It Liability Insurance Professional Liability Insurance

Errors And Omissions Insurance - Hirsch Insurance Houston Tx

Appraiser Eo Insurance Cost And Top 5 Providers - Bravopolicy

Errors And Omissions Eo Insurance Cost Insureon

Professional Liability Insurance Definition Professionalliabilityinsurance Liability Insurance Professional Liability Liability

Professional Liability Insurance Coverage Cost Quotes Advisorsmith

Posting Komentar untuk "How Much Is E&o Insurance For Appraisers"