Split Dollar Life Insurance Estate Planning

“split dollar life insurance is an arrangement between an employer and an employee to share the costs and benefits of a life insurance policy. And collateral, in which the.

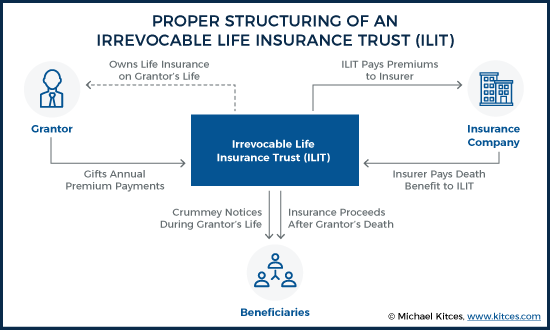

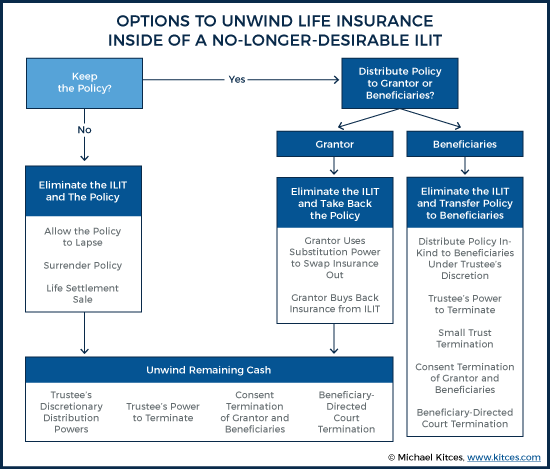

Unwinding An Irrevocable Life Insurance Trust Thats No Longer Needed

Historically, private split dollar has been used as an estate planning.

Split dollar life insurance estate planning. Endorsement, in which the employer owns the policy and reaps the benefits, but the employee chooses the beneficiary or beneficiaries and how the death benefit is paid out; The rules were disjointed and often applied inconsistently. Split dollar life insurance for estate planning.

(i) either party to the arrangement pays all or a portion of the premiums on the life insurance contract; Split dollar life insurance is widely used in gift and estate planning and can be an important part of the compensation package of many key employees. For this article's purposes, we’re.

June 24, 2021 finseca advanced markets. For high net worth individuals, it can be used as an estate planning tool. In addition, this type of policy can be used as a viable strategy for transferring wealth between a parent and child and for estate planning.

»the amount of economic benefit is determined by reference to the insurer’s regularly issued, publicly available one year term rules, or table One such plan was at the center of a recent controversy between a decedent's estate and the irs. And (ii) the party paying for the premiums is entitled to recover all or any portion of those premiums, and such recovery is to be made from the proceeds of the life insurance.

Permanent policies are more expensive than term life insurance. In its broadest application, split dollar is an arrangement whereby two parties enter into an agreement to “split” the costs (premiums) and benefits (cash value and death benefit) of a life insurance policy. There are a few major ways that split dollar life insurance policies are used by employers and employees:

Specifically, the parties join together to purchase an insurance policy on the life of the employee and agree, in writing, to split the cost of the insurance premiums, as well as the policy’s death proceeds, cash value, and other benefits. The contracts protect your life insurance proceeds from an estate tax. If your policy is owned by an outside interest, such as a trust or annuity, you don’t have to pay estate or income taxes on the death benefit.

Even if dad is still insurable, cost of insurance charges will likely be lower using family split dollar, since the insured in this case is younger. Estate of morrissette and intergenerational split dollar. Split dollar life insurance is widely used in gift and estate planning and can be an important part of the compensation package of many key employees.

Wealthy individuals can also form agreements called private split. Let’s say, for example, you have a large estate and are looking for a strategy to minimize estate taxes. Private split dollar, also know as family split dollar or generational split dollar, may take many forms.

What can split dollar life insurance be used for?

The Tools Techniques Of Life Insurance Planning 8th Edition

Split Limits Of Liability Umbrella Insurance Car Insurance Auto Insurance Quotes

Rntsplit Dollar Life Insurance Policy Definition Taxation I Beamalifern Penn State University University Studying State University

Whole Life Insurance What You Need To Know White Coat Investor

Perencanaan Keuangan Yang Ideal Perencanaan Keuangan Keuangan Panduan Belajar

Life Insurance-financial-planning-advisory-kuber-mindz Moneymindz Financial Advisory Financial Planning Insurance

Bank Account Information A5 A4 Us Letter Half Letter Etsy In 2021 Finance Planner Financial Planner Printables Planner Inserts Printable

Facts To Know About Financial Planning Education Plan Teaching Skills Financial

401k Vs Life Insurance Which Is Better For Your Needs

Pin By Christina Walsh On Frugal Finance Real Wealth Budgeting Money Financial Freedom Financial

Financial Statement Personal Example 5 Ways Financial Statement Personal Example Can Impro In 2021 Personal Financial Statement Financial Statement Statement Template

Unwinding An Irrevocable Life Insurance Trust Thats No Longer Needed

/GettyImages-114329820-f31a1e4ea99947d488b7d35cfe5bd1b8.jpg)

How Split Dollar Life Insurance Works

Nomedicalinfograph Life Insurance Companies Life Insurance Policy Life Insurance

Financial Statement Template Personal Financial Statement Template Financial Statement Temp Personal Financial Statement Financial Statement Statement Template

Split-dollar Life Insurance Explained - Nerdwallet

Personal Financial Statements Template Elegant 8 Financial Statement Samples Examples Templ In 2021 Personal Financial Statement Financial Statement Statement Template

Posting Komentar untuk "Split Dollar Life Insurance Estate Planning"