Named Insured Vs Additional Insured Property Insurance

The named insured in the auto policy is the owner of the vehicle. As an additional named insured, they will usually have more coverage than the additional insured(s).

Certificate Holders Additional Insureds Whats The Difference

An additional insured is someone who is not the owner of the policy but who, under certain circumstances, may be entitled to some of the benefits and a certain amount of coverage under the policy.

Named insured vs additional insured property insurance. The additional insured will only relate to the liability. Named insured vs additional insured • the named insured and additional insured are terms that usually appear on an insurance policy. By adding the additional insured, that party now receives the same coverage as the owner of the insurance policy.

Insurance requirements for property vary depending on the situation. Naming the principal an “additional insured” would allow them to claim against your insurance. In a commercial liability policy the first named insured terminoloy appears in the definitions.

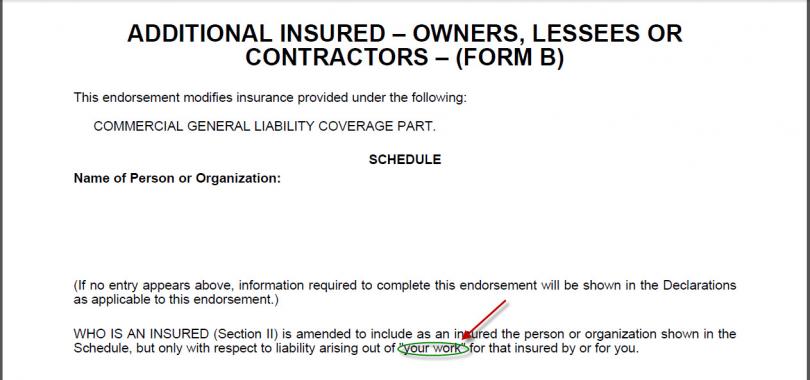

A auto policy endorsement is required to be named as an additional insured. The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage. The named insured party has more responsibilities because of the needs of the policy.

A named insured and additional insured will have insurable interests in the same object but for different reasons. “joint insured” means claims could go against either your or their. Owns the policy, owes the premium, has all the rights.

An additional insured is an entity who is not the policyholder, but is entitled to some of the benefits of the policy because of a direct business relationship to the named insured. Don't take it at face value. Both the categories of the homeowner insurance are equally relevant and have plenty of benefits.

So what’s the difference between an additional insured and an additional named insured? Other parties involved with your property may require special protection as part of your property insurance policy, and may ask to be named as a loss payee or additional insured. the terms are similar, but have very different. The coverage afforded to an additional insured is.

Who is a loss payee? An additional insured is a third party added to the insurance policy of another entity known as the named insured. Unlike an additional insured, an additional named insured will have the same status and rights as the original named insured.

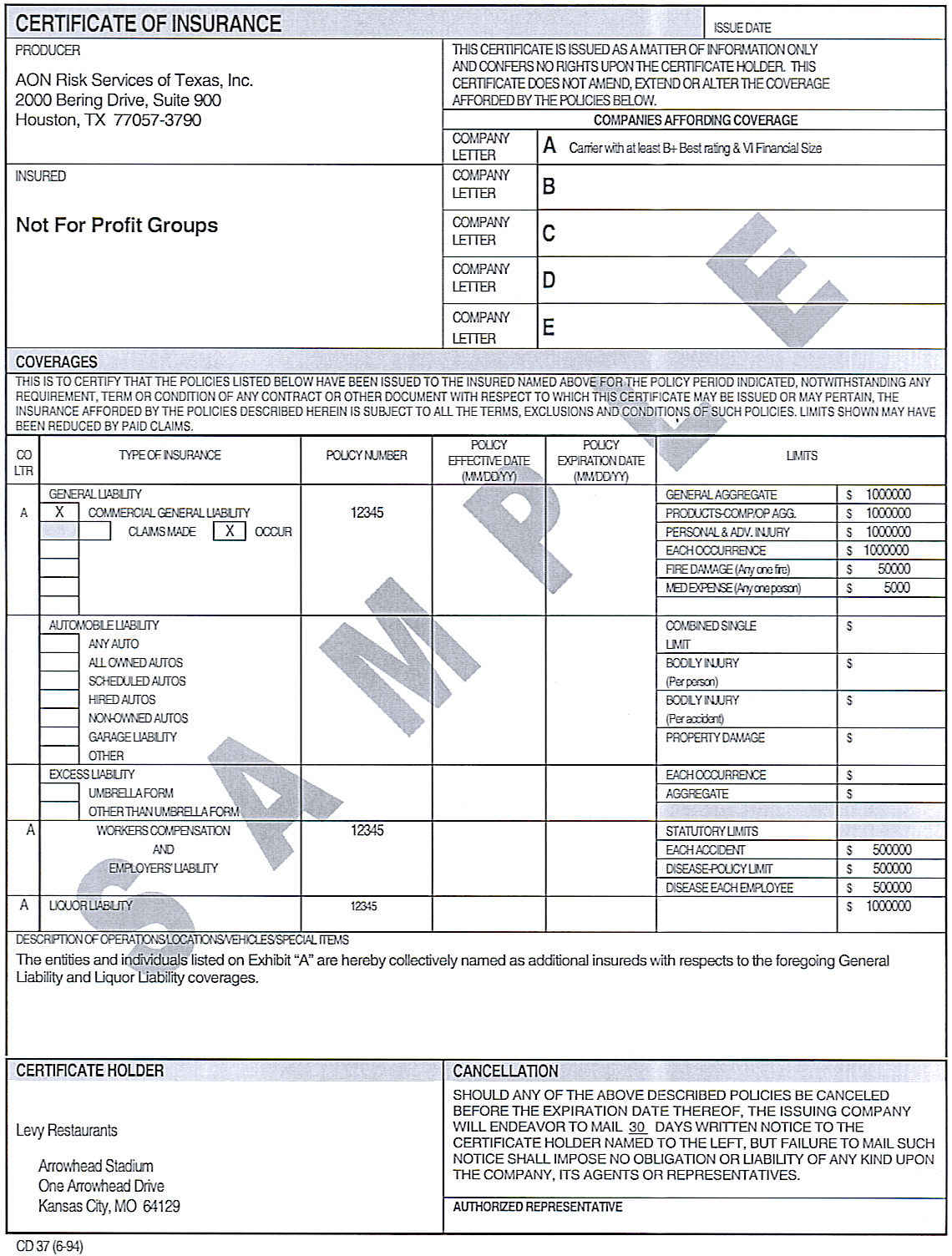

In property insurance, additional insured status is most often used in conjunction with a premises lease agreement between the named insured as the lessee and the owner of the leased building, in which the insured tenant is required to purchase insurance on the leased building and name the building owner as an additional insured on the insurance policy with respect to the leased building. However, the policy will cover the additional insured only for damages that have been incurred for operations that were performed on behalf of the named insured. Often an additional named insured is a subsidiary of the first named insured who has the same or very similar operations to the first named insured.

Contract requires property to be insured against loss or damage and the principal has an insurable interest in the property. By contract with acme, abc will be held responsible for any damage to the copier. The additional insured cannot alter the coverage, but it can use the policy in the event of a claim or lawsuit caused.

Both additional insureds and loss payees are entitled to receive insurance benefits along with the named insured. Added to the policy by endorsement due to a relationship with the named insured, and what they get will vary depending on policy form. There is not a simple solution, and this can depend upon the type and nature of the project, in addition to the country/region where the project is situated.

Coverage for an additional insured is usually tied to the premises, work, or services that are the focus of the business relationship between the additional insured and the named insured. On the contrary, additional insured party enjoys similar benefits while not being subjected to a lot of responsibilities. 3) how can we provide cover and give comfort to insurers?

Since your insurance only covers your negligence, an insurance company may agree to make the principal an additional insured as they are assuming no new or additional risks. This is a summary of a summary of a summary. A named insured is entitled to 100% of the benefits and coverage provided by the policy.

Updated september 2010 “named insured”, “interested party” or. Abc manufacturing company is a named insured in a property policy and leases a copier from acme leasing company. In a property policy, the named insured has all the benefits of the property, but when you go to the liability you can have an additional insured added on your policy to protect someone else because they’re related in some way to the liability.

5 insured vs insured and related parties entities exclusions and the implications for professional indemnity/liability insurance. A typical auto policy additional insured endorsement is the lessor of a vehicle. Additional insureds • named insureds persons or organizations specifically named in the policy first named & additional named insureds • additional insureds individuals or entities that enjoy “insured status,” but are not named insureds two types of.

For instance, many businesses satisfy lease requirements by insuring their landlord under their liability policy using a standard iso additional insured endorsement.

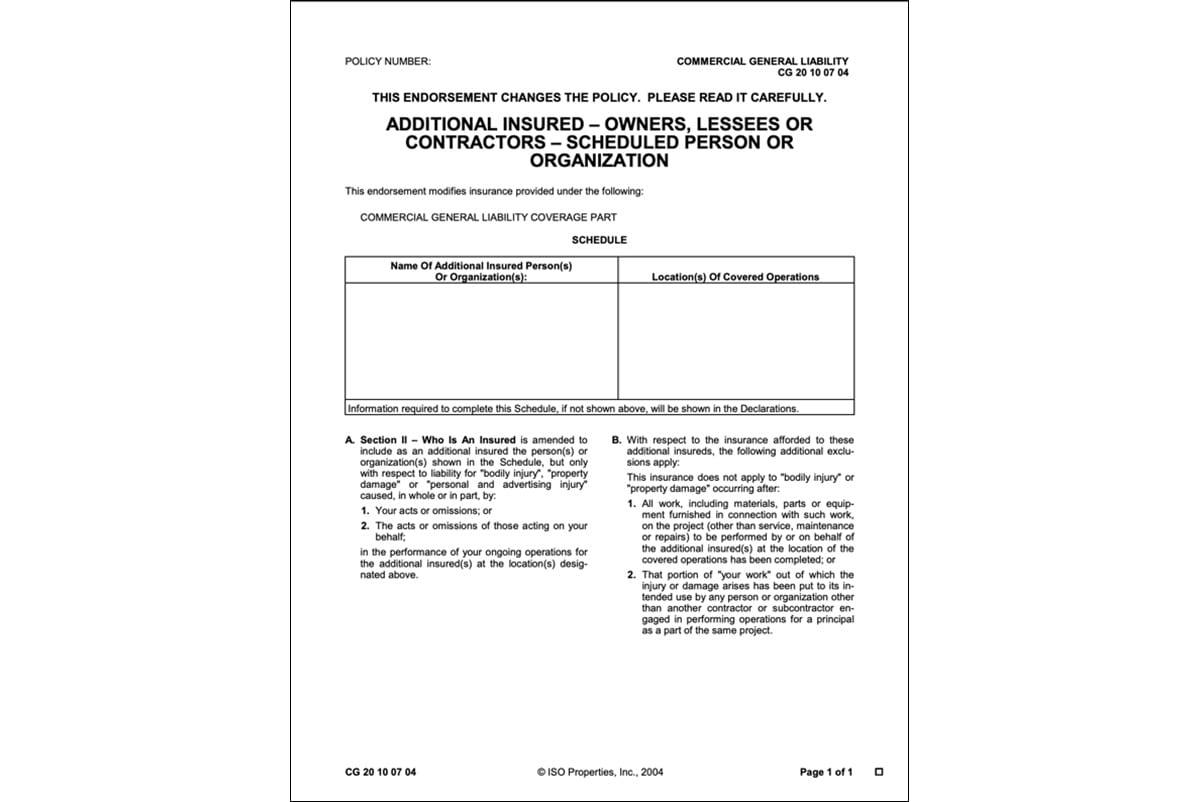

Additional Insured Endorsements In Construction

Named Insured Vs Additional Insured Coverwallet

Protecting Your Firm As An Additional Insured - Virginia Independent Insurance Agent

The Difference Between Named Insured Additional Insured And Named Additional Insured

Understanding Your Rights As An Additional Insured - Florida Construction Legal Updates

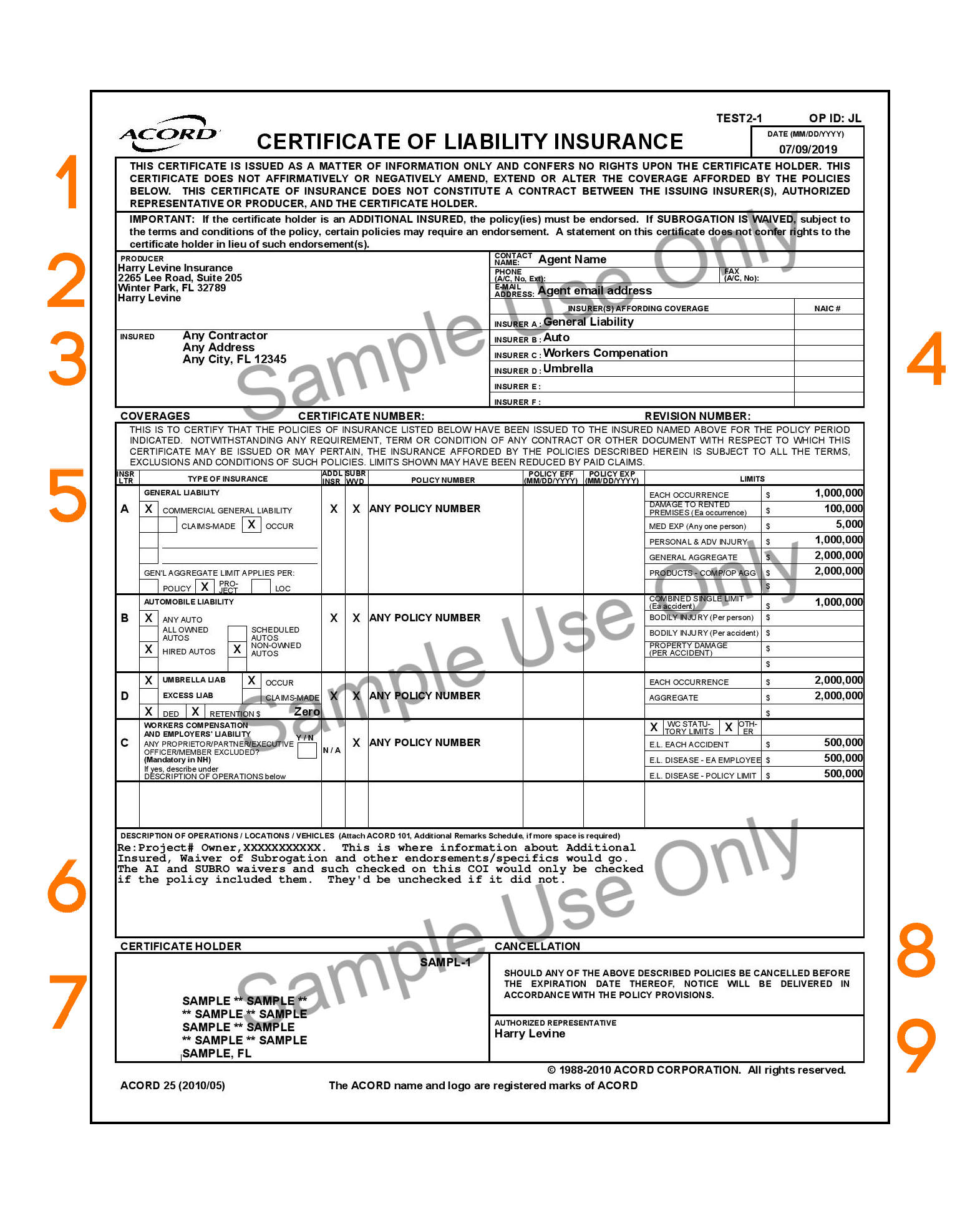

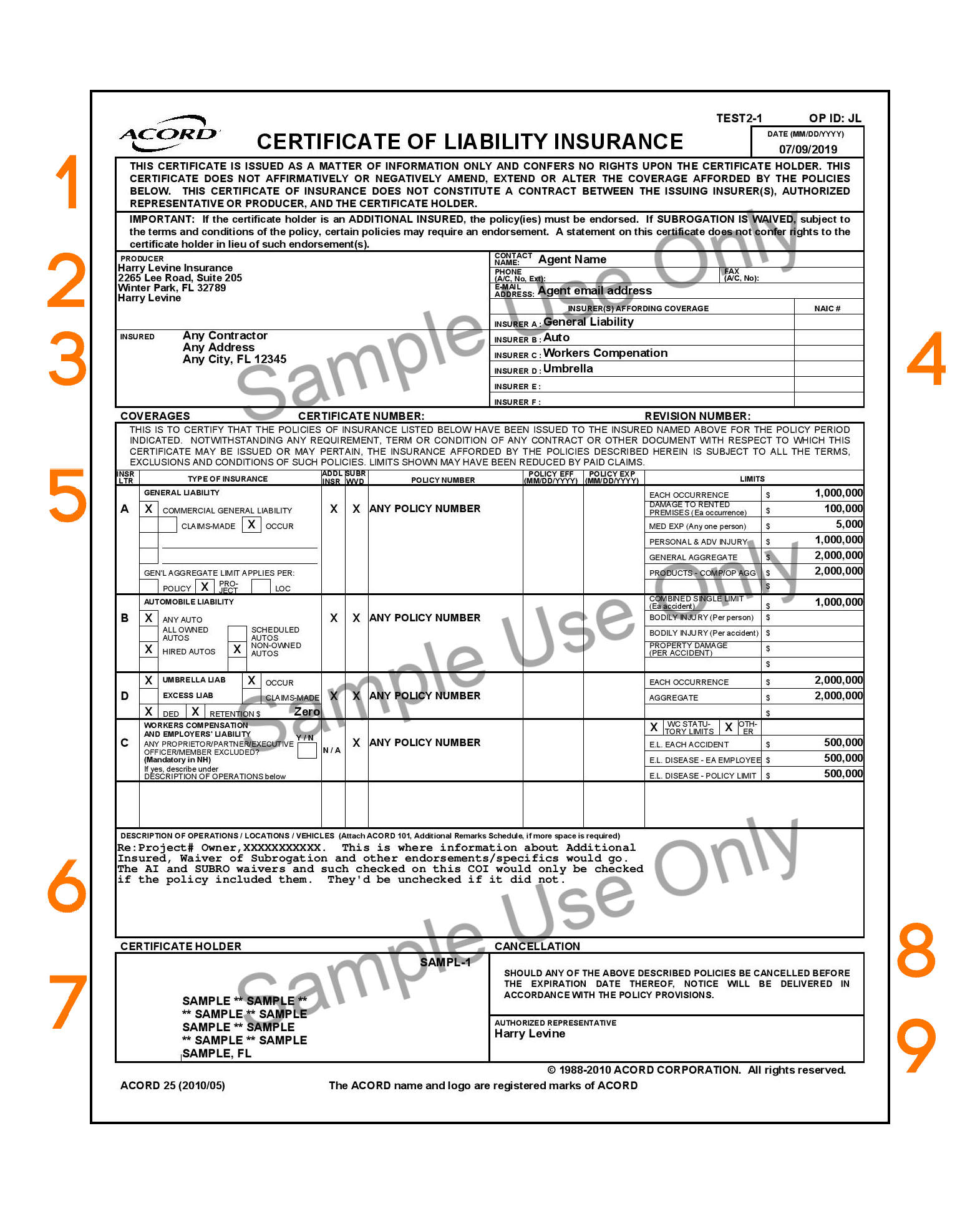

Understanding Your Certificate Of Insurance - Harry Levine Insurance

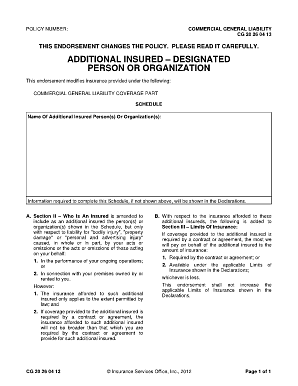

The Additional Insured Endorsement - Briggs Agency

Whats The Difference Between A Loss Payee An Additional Insured

Are You Really An Additional Insured

Understanding Cois - Certificate Holder Vs Additional Insured

Additional Insured A Look At Iso Cg2010 - Blades Risk

What Is An Additional Insured Endorsement - Cost Coverage 2021

Understanding Your Certificate Of Insurance - Harry Levine Insurance

Additional Insured Vs Loss Payee - Embroker

Certificate Of Insurance Moving Example - Insurance

Posting Komentar untuk "Named Insured Vs Additional Insured Property Insurance"