Self Insured Retention Limit

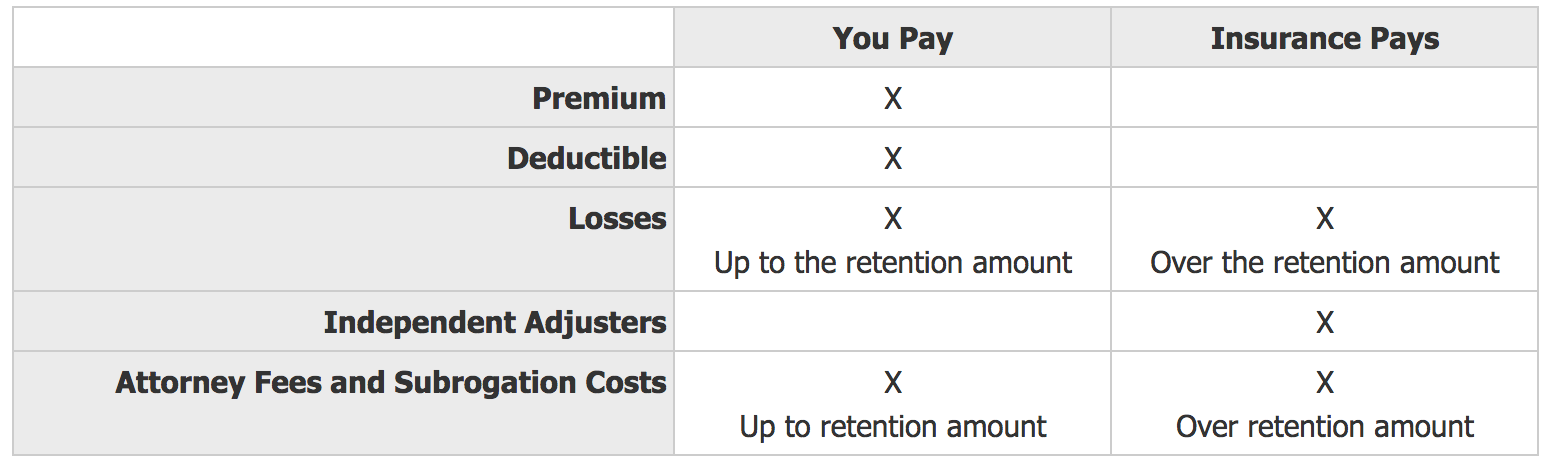

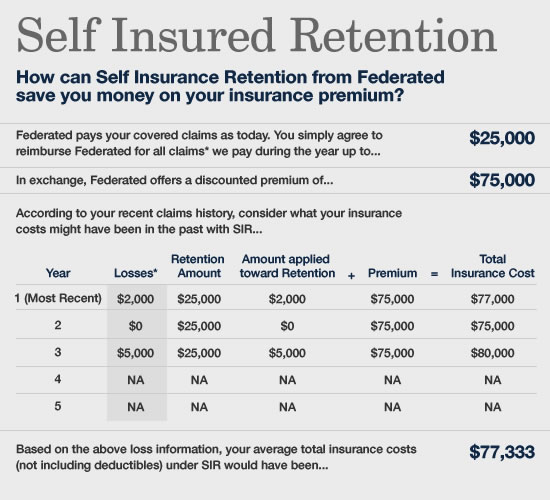

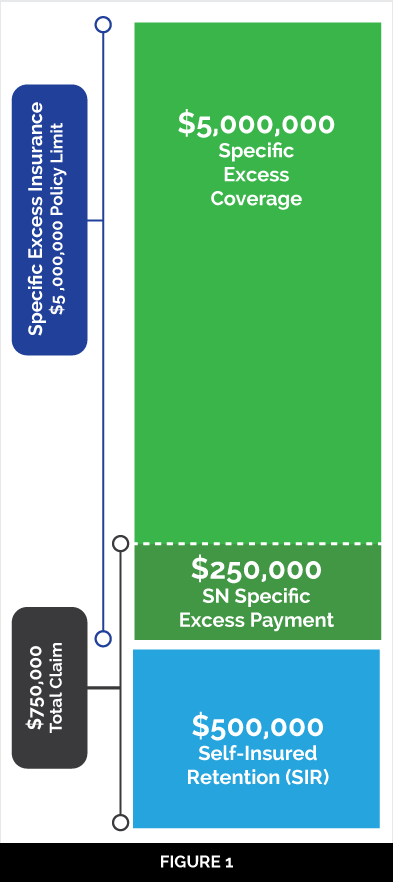

Under a liability insurance policy with a sir provision, the business must cover a set dollar amount before the insurance company begins to pay out claims. If an umbrella policy provides coverage for circumstances that are excluded by an underlying policy (such as personal injury under a homeowners policy), the insured pays a selected retention limit, typically between $250 and $10,000 which acts like a deductible, and the insurance company pays the loss over that amount.

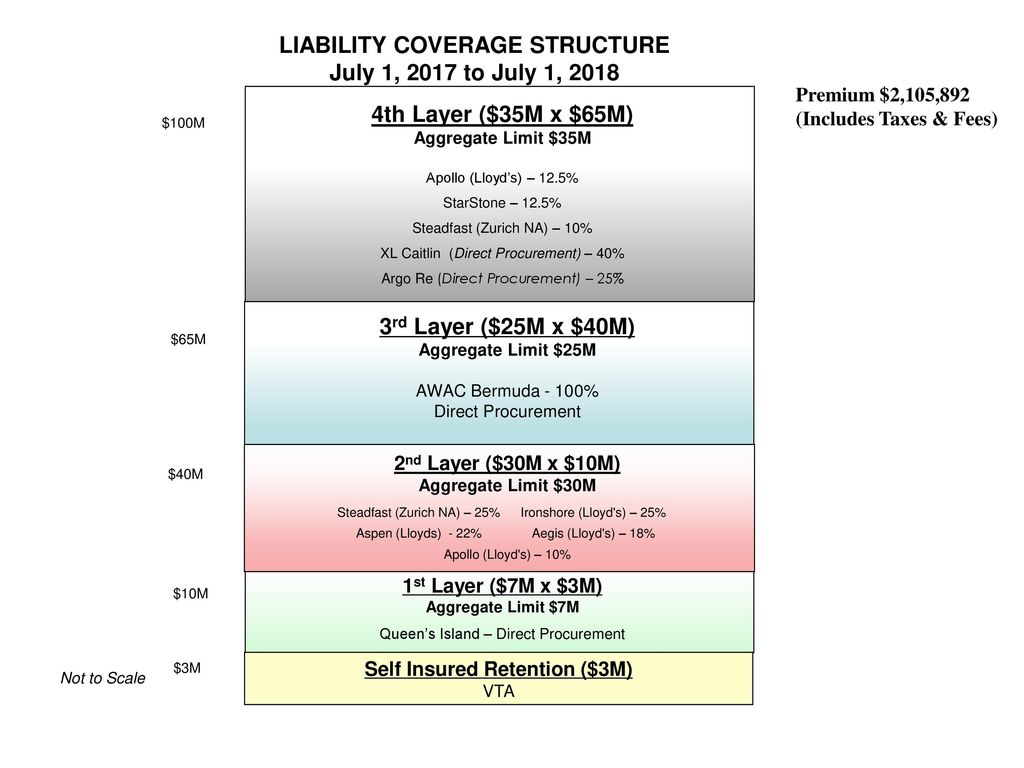

Liability Coverage Structure Self Insured Retention 3m - Ppt Download

Sirs allow businesses to retain or.

Self insured retention limit. The sir can be one tactic. The insured has the responsibility to pay it directly to the plaintiff, instead. For example, if you are insured through a liability policy with a $1 million limit and a $100,000 sir, you’ll need to pay for the first $100,000 of any claim before your insurer begins to cover the claim.

With a deductible, your total policy limit is still $1,000,000 but that includes your $50,000 deductible. Essentially this means your insurer only provides $950,000 in coverage once you’ve paid your deductible. Thus, under a policy written with a self insured retention provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until the self insured retention limit was reached.

$ each occurrence $ per claim and the insured agrees to assume the retained limit. Thus, under a policy written with a sir provision, the insured (rather than the insurer) would pay defense and/or indemnity costs associated with a claim until the sir limit was reached. Whether a company has a high deductible or an sir limit, the company, like an insurance company, can pursue tortfeasors to recover the amount of money the company paid.

As premiums increase in the commercial habitational sector, an increasing number of organizations seek alternatives to reduce insurance costs. Under an sir the insured is responsible for all expenses associated with defending claims until the sir is exceeded.

Self-insured Retention What It Is And How It Works - Harris Insurance

Self-insured Retentions Part 2 An Examination Of The Uses And Proble

Self-insured Retention An Alternative To The Insurance Deductible - Reshield

Excess Liability And Commercial Umbrella Coverages - Ppt Download

Sir A Profit Center For Your Business American International Automobile Dealers

Excess Liability Vs Umbrella Liability - Ppt Download

Self-insured Retention Vs Collateral

Self-insured Risks - Captive Insurance 101

Umbrella And Excess Five Key Issues Q The

The Corridor Self-insured Retention Expert Commentary Irmicom

Self-insured Retentions Part 2 An Examination Of The Uses And Proble

Deductibles Vs Self-insured Retention

Liability Coverage Structure Self Insured Retention 3m - Ppt Download

Sir A Profit Center For Your Business American International Automobile Dealers

Self-insured Retentions Versus Deductibles Expert Commentary Irmicom

Self-insurance Text Only Version - Safety National

Self-insured Retentions Part 2 An Examination Of The Uses And Proble

Posting Komentar untuk "Self Insured Retention Limit"