Sr22 Insurance Florida Requirements

Florida sr22 insurance quotes and details about state requirements. Sr22 insurance must have the following minimum coverage:

Florida Auto Insurance Rates By County Car Insurance Auto Insurance Quotes Florida

Serious moving violation conviction, such as reckless or negligent driving;

Sr22 insurance florida requirements. Common circumstances that result in an sr22 insurance requirement include the following: The length of time you must carry sr22 insurance and sr22 requirements can vary depending on your situation. Florida sr22 insurance information there are many reasons why a driver may require the sr22 filing to florida’s bureau of financial responsibility.

Dui or dwi or other major alcohol violation conviction; Florida fr44 insurance requirements and payment considerations the minimum insurance coverage for standard and sr22 insurance is 10/20/10. This certificate of financial responsibility is vital for those who have been deemed risky drivers.

Sr22 in florida requires that high risk drivers carry $10,000 of bodily injury coverage for one person, $20,000 for injury to two or more, and $10,000 for property damage. If a driver in florida is convicted of an alcohol related offense (e.g., dui) after october 1, 2007, he or she will need to file an fr44 form with the florida department of highway safety and motor vehicles. You are convicted of a dui/dwi.

This ensures all drivers maintain the auto insurance mandated by the florida government. Ad compare the best coverage online in minutes. If you’re not a vehicle owner, see florida non owner sr22 insurance for more information.

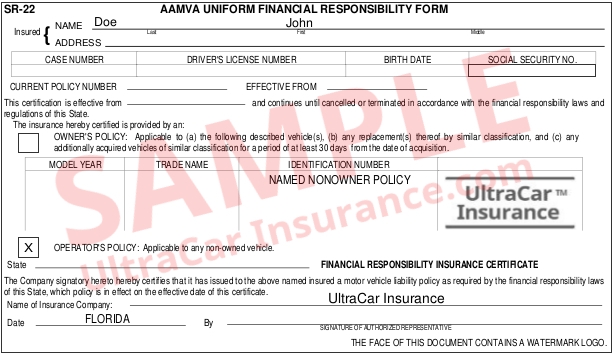

It is evidence that you have a policy. Get free online quotes from multiple carriers in florida to find you the lowest rate on sr22 insurance. Types of sr22 insurance in florida.

If you live in texas, florida, or missouri, you need to fill in the sr 22a form upon severe traffic violations. Compare that to the minimum coverage for fr44 dui insurance, which is much higher: In fact, if they don’t carry it, they will be reported to the state and lose their right to drive.

Florida sr22 insurance is available if you own a vehicle, or if you don’t. What is the florida minimum sr22 requirement? The insurer sends this proof to the dmv to show that you have met the requirement.

In this event, you must obtain an sr22 policy again and also reinstate your license with the dmv including paying the dmv reinstatement fee which is usually around $55. $40,000 for damage resulting from one accident $25,000 for death or injury to one person (it can be. There are three main types of sr22 insurance in florida.

The sr21 insurance has to be filled if you have received a traffic ticket or were in an accident. Who needs sr22 insurance in florida? Ad compare the best coverage online in minutes.

It is evidence that you have a policy. Several traffic offenses in a short time period; The florida sr22 is not an insurance policy.

For this form, you must pay for your insurance policy in full for six months or more. In some cases, sr22 insurance is also required if you have too many violations on your driving record. Here are the florida sr22 requirements to get sr22 insurance fl:

An sr22 is proof of your coverage. This means that he or she will need to purchase florida fr44 insurance. Typically, a florida sr22 is required when a driver seeks to reinstate a driver’s license after being convicted of a dui, reckless driving, driving without insurance, or some other driving violation that’s resulted in a suspension.

$10,000 bodily injury per accident You might be required to carry the sr22 filing if you were caught driving without insurance.

Compare Cheap Auto Insurance Quotes Pretected Auto Insurance Quotes Insurance Quotes Car Insurance

Pin By Colucci Insurance On Httpwwwcolucci-insurancecom Insurance Quotes Florida Insurance Commercial Insurance

The Worst Advices Weve Heard For Metlife Auto Insurance Metlife Auto Insurance

Dairyland Auto Insurance Pay Online In 2021 Car Insurance Cheap Car Insurance Insurance

Sr-22 Filing Sometimes Referred To As Sr-22 Insurance Or Non- Owners Policy In Florida Can Be Confusing And Stressful To Dea Personal Insurance Sr 22 Insurance

Drivers Who Do Not Own Their Own Vehicles But Are Still Required To Carry Financial Resp Life Insurance For Seniors Life Insurance Policy Life Insurance Quotes

Progressive Auto Insurance Fax Number In 2021

Best Cheap Car Insurance In Florida For 2021 In 2021 Cheap Car Insurance Best Cheap Car Insurance Car Insurance

Usaa Auto Insurance Claim Number In 2021

Sr22 Insurance Florida Fr44 Form South Florida Boca Raton

Auto Insurance Providers In Florida In 2021

Best Cheap Sr-22 And Fr-44 Insurance In Florida - Valuepenguin

Florida Insurance Requirements - Florida Department Of Highway Safety And Motor Vehicles

Example-florida Sr22 Certificate Ultracar Insurance

Pin On Cheap Insurance Quotes For Hyundai Accent 2004

Posting Komentar untuk "Sr22 Insurance Florida Requirements"